A thorough AI business strategy offers unique possibilities for companies and organizations, from increasing creativity in decision-making to improving resource allocation and risk mitigation. Despite ethical considerations and cybersecurity challenges, organizations can counter-measure and often avoid them by increasing oversight, developing training datasets, and setting transparent processes in generative AI. As businesses embrace data-driven cultures, generative AI becomes crucial to automating tasks, raising efficiency, and unlocking new revenue streams that reshape traditional business models.

How Generative AI is Displacing Traditional AI in the C-Suite

Traditional AI is good at evaluating large datasets and getting valuable insights, but generative AI is inherently more creative in how it works. C-suite executives recognize the potential of generative AI in allowing them to explore other avenues and form innovative strategies that are harder to achieve with more conventional analytical methods.

Traditional AI processes historical data and identifies patterns well but has difficulty adapting to evolving market conditions. Generative AI, on the other hand, can understand context and recognize the intricacies of dynamic markets effectively. By understanding the real-time data and external factors, generative AI allows C-suite executives to go beyond statistical analysis.

Integrating Generative AI into Business Strategies

By using the creative abilities of AI, businesses unlock several possibilities, creating ideas and solutions not found in traditional approaches. Businesses that add generative AI into their strategies add a competitive advantage by being more active, responsive, and forward-thinking.

Optimizing Resource Allocation

By analyzing complex datasets, generative AI finds essential patterns and trends that might be missing in traditional analytical methods. This insight allows decision-makers to make choices based on understanding the full dynamics of operations. Also, generative AI’s ability to predict various scenarios helps in strategic resource allocation, optimizing efficiency, and minimizing waste.

Unlike established methods that rely on historical data, generative AI can model several potential scenarios, considering various factors. Whether considering market fluctuations, operational challenges, or unanticipated troubles, generative AI lets decision-makers anticipate outcomes and fine-tune resource distribution strategies.

Data-Driven Decision Support

By leveraging AI, organizations reduce hesitation in strategic AI implementation as the technology explores the variables and factors that influence business outcomes. The insights found from in-depth analysis help decision-makers adopt a more informed approach.

Unlike some methods with preset considerations, generative AI independently explores data, looking for hidden patterns. Doing so removes the need for complex data analysis and supports the discovery of unknown relationships and trends.

Risk Mitigation and Scenario Planning

Through advanced analytics and learning, generative AI recognizes patterns and differences that indicate developing threats or challenges. By identifying risks, companies can develop AI strategic planning and adapt their strategies to navigate uncertainties effectively. Generative AI’s real-time analysis and predictive abilities offer a responsive approach to risk management, enabling organizations to stay ahead in rapidly changing times.

AI Business Strategy: Challenges and Ethical Considerations

When integrating generative AI into business strategies, there are challenges. One primary concern is the ethical consequences surrounding using AI-generated content because ensuring fairness, accountability, and transparency is essential. The lack of unambiguous interpretation of generative models raises another challenge, as the detailed algorithms of the systems can sometimes produce difficult-to-understand results. Additionally, leveraging generative AI requires a strong cybersecurity infrastructure, as the technology becomes a potential attack target.

Another concern of generative AI is the ethics of using AI content, as organizations deal with bias, fairness, and accountability issues. Finding a balance between innovation and ethical use requires constant monitoring to address potential negative consequences.

Organizations can take steps for risk mitigation and ensure ethical implementation:

- Robust oversight and governance mechanisms.

- Training generative models on wide-reaching datasets.

- Emphasize user consent and privacy protection measures to build trust.

- Educate employees and stakeholders on the ethical use of AI.

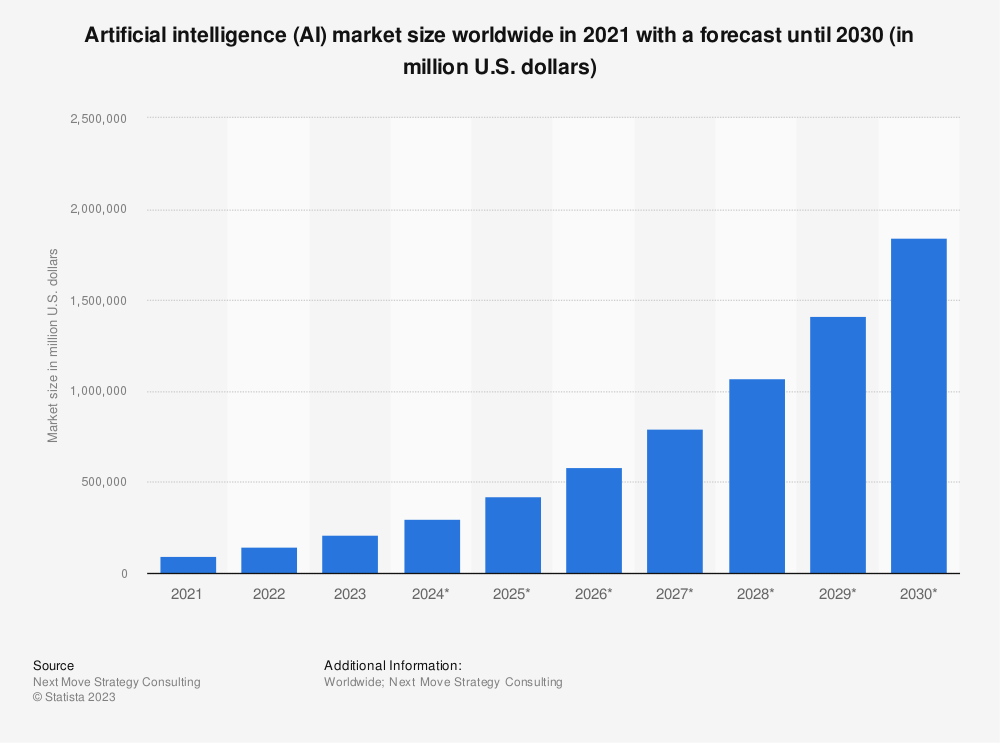

Future Trends and Implications for Executives

C-suite executives strategically harness growing trends in AI and generative AI, ensuring they remain alert and modern in the business landscape.

Edge AI and Decentralized Processing

Edge AI and decentralized processing enable the use of AI algorithms directly on devices instead of on centralized cloud infrastructure.

AI-Powered Health Tech Innovations

Innovations in AI are changing the healthcare industry, ranging from specialized treatment plans to predictive diagnostics. Integrating generative AI into health tech improves medical image generation and drug discovery.

Quantum Computing’s Influence on AI

The collaboration between quantum computing and AI is positioned to increase processing capabilities and revolutionize complex problem-solving in AI applications.